Trading 212 is a financial technology platform based in the UK that allows you to trade without paying any fees on your transactions. You can invest in a wide range of options, such as shares, exchange-traded funds (ETFs), and contracts for difference (CFDs).

Launched in 2005 and available to UK users since 2016, it has attracted a large number of users thanks to its easy-to-use design and variety of investment choices. Whether you’re a beginner or an experienced investor, Trading 212 makes it simple to get started with your investments.

Key Features of Trading 212: What You Need to Know

No Commission Fees: With Trading 212, you can invest in a wide variety of assets without paying extra fees for each trade. This makes it an affordable option for everyone, whether you’re just starting out or have been investing for years.

Wide Range of Investment Options: You can choose from more than 10,000 stocks and exchange-traded funds (ETFs) from major stock markets around the world. Additionally, there are options to invest in contracts for difference (CFDs) related to currencies, commodities, and market indices.

Easy-to-Use Platform: Whether you prefer using a computer or your smartphone, the Trading 212 platform is designed to be user-friendly. It provides helpful tools and resources that guide you in making smart investment choices.

Regulated by Financial Authorities: Trading 212 is regulated by the UK’s Financial Conduct Authority (FCA), which means they follow strict rules and standards. This regulation helps ensure that your investments are safe and secure.

Also Read: https://wealthilyyours.com/is-trading-212-cash-isa-good/

Step-by-Step Guide to get started

1. Eligibility

- First things first, check if you qualify.

- You need to be a resident of the UK and at least 18 years old to get started.

2. Signing Up

- Head over to the Trading 212 website or grab their app on your phone.

- You’ll need to register by entering your email and setting up a strong password.

3. Verifying Your Account

- To keep everything secure, you’ll have to provide some personal details, like proof of who you are and where you live. This is just a standard procedure they follow.

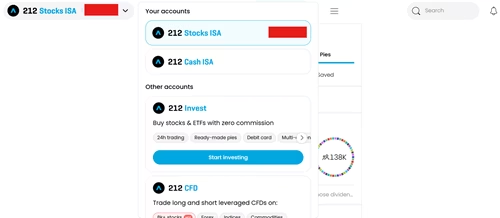

4. Choosing Your Account Type

- When you’re setting up your account, you will see 4 options to select from: Cash ISA, Stocks and Shares ISA, Invest and CFD.

- Select your preferred option, for my example I have selected the Stocks and Shares ISA.

- This will help you manage your investments in a tax-efficient way.

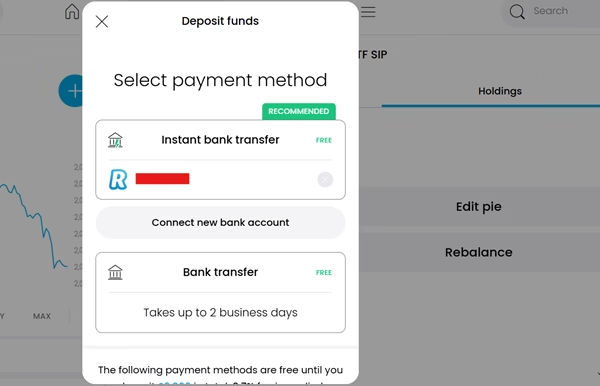

5. Adding Funds

- Next, it’s time to put some money into your ISA account.

- You can transfer funds from your bank or use a debit card – just remember that there’s an annual limit of £20,000 for how much you can contribute this tax year.

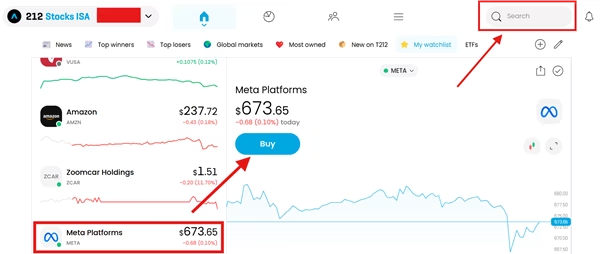

6. Exploring Investment Choices

- Once funded, take some time to look through the stocks and ETFs available in your ISA.

- The platform also offers handy research tools that can help you evaluate which investments might be right for you.

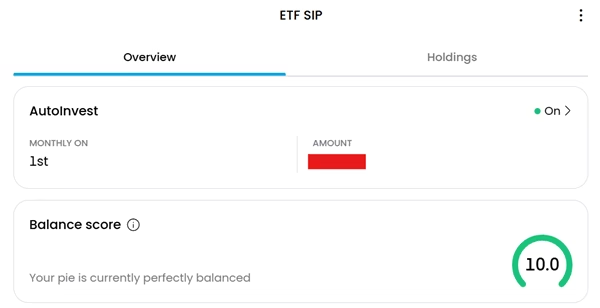

- I myself prefer creating a pie of different assets I want to invest in and turn on the “auto invest”. All I need to do is park some funds in my trading 212 account every month and the amount gets automatically invested in the stocks/ETFs I have added to my pie.

7. Making Your Investment

- When you’ve found something you’d like to invest in, simply select it.

- Decide how many shares or how much money you’d like to put in, then review everything before confirming your order.

8. Keeping Track of Your Investments

- After you’ve made some investments, it’s important to regularly check on how they’re performing.

- You might want to set up alerts or use the platform’s features so you’re always updated on market changes.

When it comes to investing your money wisely, understanding the types of accounts available is crucial. A Stocks and Shares ISA lets you put your money into different investments without having to pay taxes on any profits you make. On the other hand, a Cash ISA is more like a regular savings account where the interest you earn is also tax-free.

It’s important to know which option suits your financial plans best. By making an informed choice, you can kickstart your investment journey with Trading 212’s Stocks and Shares ISA. This way, you’ll be able to grow your money in a tax-friendly manner and take full advantage of the opportunities that come your way.

Also Read: https://wealthilyyours.com/best-way-to-invest-10000-in-the-uk/

FCA Disclaimer:

This article is for educational and informational purposes only and does not constitute financial advice. Always consult a qualified financial adviser regulated by the Financial Conduct Authority (FCA) before making financial decisions.

Enjoyed the Post? Share Your Thoughts and Spread the Word!

If you found this blog post informative and helpful, I’d love it if you could share it with your friends, family, or anyone who might benefit from it. Your support helps me reach more readers and continue creating content like this!

Also, I’d love to hear from you! What are your thoughts on the topic? Do you have any questions or insights to add? Drop a comment below - I’m here to chat and learn from your perspective too.

Thank you for being part of this journey, and I can’t wait to hear what you think!

WealthilyYours Empowering You to Grow, Invest, and Thrive

WealthilyYours Empowering You to Grow, Invest, and Thrive